Learnings from (un)successful DDs: Deal timing

| Published |

|---|

On average I see over 1,000 deals per year, DD in more significant detail 10-15, and invest in 2-4. This means there is quite a bit of time spent on deals that didn't make it. But, whether I invest or pass on deals, there is always learning. This post is part of a series on learnings from (un)successful DDs.

Deal timing is paramount in deep tech investing (for seed non-VC investors)

The defining characteristic of deep technology is defensibility. Building a defensible product takes time and specialised knowledge.

Founders provide specialised knowledge. Investors pay for time (and for hired specialised knowledge and resources). The longer it takes to get to a liquidity event, the higher the bill.

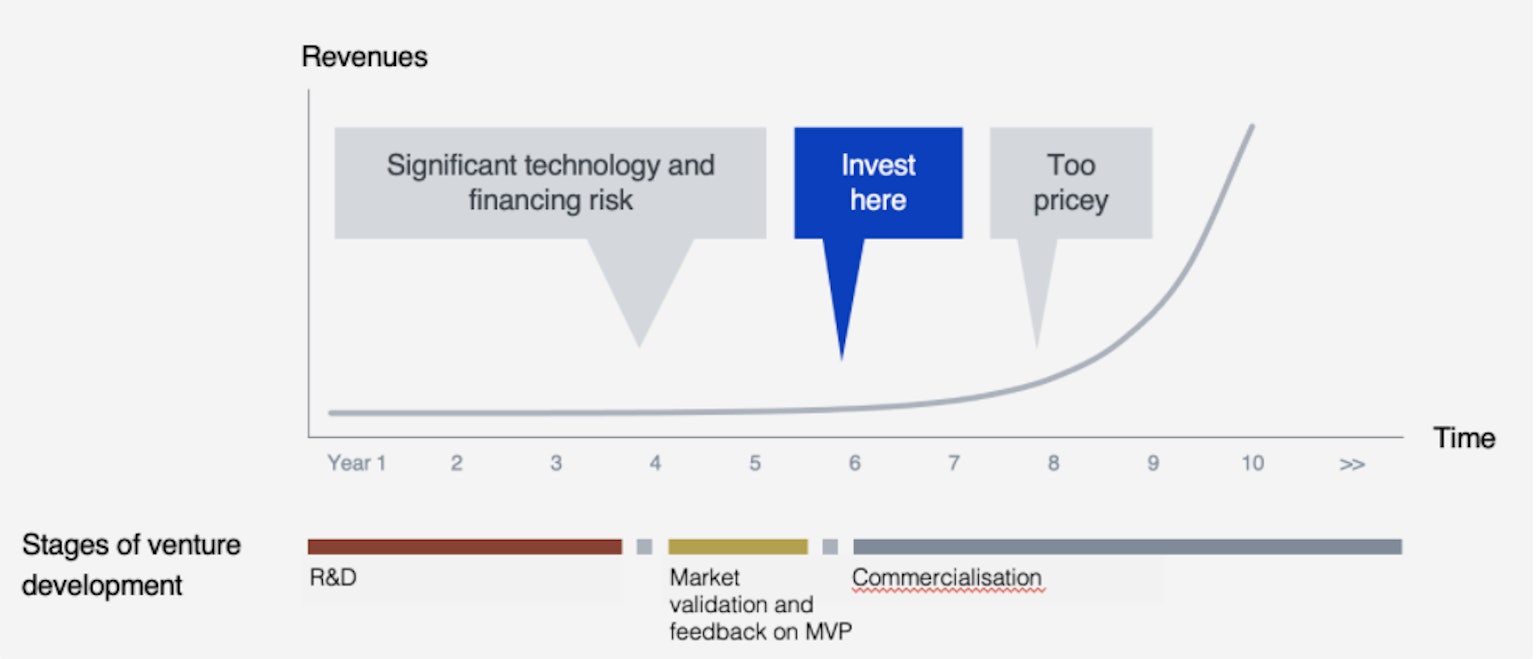

A typical R&D cycle in hard deep tech is 5-7 years, and at times it crosses a decade (timelines vary for hardware and software). It is a bumpy road, with plenty of failed experiments amidst few wins that keep the spirits going. Delays are common. These years are partially financed by grants and partially by early stage investors. If the early stage investors don’t have deep enough pockets to sustain the venture over the R&D years, the research slows down, or stops. And that’s it.

The technology risk is high. It takes time to get the tech right. And therefore the financing risk to keep the venture going is high.

A seed deep tech investor should be mindful of where the company is on the development timeline and who is on the cap table. If the venture is backed by deep pockets able to sustain the R&D development, the financing risk is lower. If the cap table lacks institutions with loads of patient capital, I would pass and seek to invest post-R&D and market validation and at the brink of commercialisation. The problem is that by that time access to the deal is limited or the price is too high to achieve the target returns. A way to play is to be part of a syndicate, where the common check size is larger, and therefore access is possible alongside institutions.

Illustrative deep tech venture development timeline

Learning: Pure deep tech as a portfolio strategy is not for (light-touch) angels.

We will continue to pursue deep tech but will ensure that the entry timing is right and the investor base around the capable is suitable for the long road ahead.